How Real Estate Crowdfunding Works

Real estate crowdfunding is a modern investment approach that allows individuals to pool their money with other investors to participate in real estate opportunities that would otherwise be inaccessible to them. Through online platforms, investors can browse and select from various pre-vetted real estate projects, investing as little as $10 to $1,000 depending on the platform.

These platforms handle all the legal documentation, payment processing, and investor communications, making it possible for everyday investors to access institutional-quality real estate investments with professional management.

Comparing Investment Methods

Direct Ownership

- ✓Full control over property

- ✓All profits go to you

- ✗High capital requirements

- ✗Active management required

- ✗Limited diversification

Crowdfunding

- ✓Low minimum investments

- ✓Professional management

- ✓Access to institutional deals

- ✓Easy diversification

- ✗Platform fees reduce returns

REITs

- ✓High liquidity

- ✓Broad diversification

- ✓Regular dividend income

- ✗Stock market correlation

- ✗No property selection control

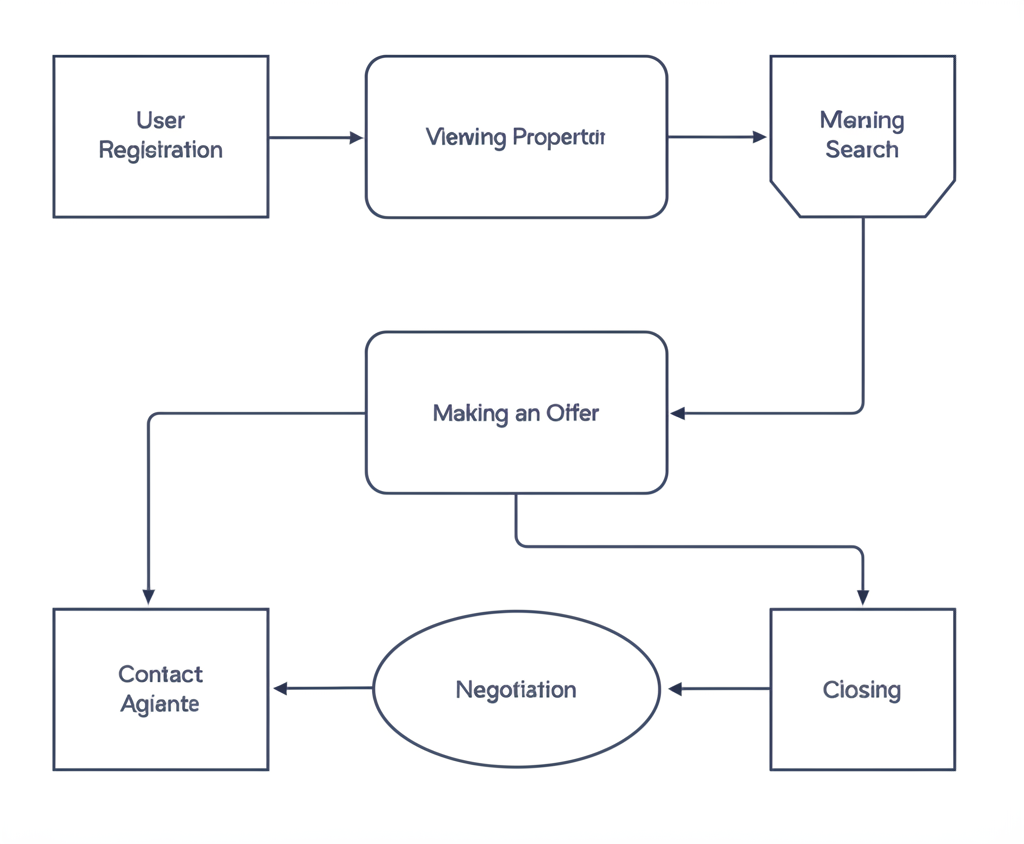

How Platforms Connect Investors to Deals

Real estate crowdfunding platforms serve as intermediaries between investors and real estate opportunities. Here's how the process typically works:

- 1Sponsor Submission: Real estate companies (sponsors) submit their projects to the platform for review.

- 2Due Diligence: The platform conducts thorough vetting of the sponsor and project, rejecting many proposals.

- 3Listing: Approved projects are listed on the platform with detailed information for investors to review.

- 4Investment: Investors browse opportunities and invest in projects that match their goals.

- 5Management: The platform handles all paperwork, distributions, and investor communications throughout the investment lifecycle.

Key Takeaway

"You don't need millions to invest in real estate — just the right platform and information."